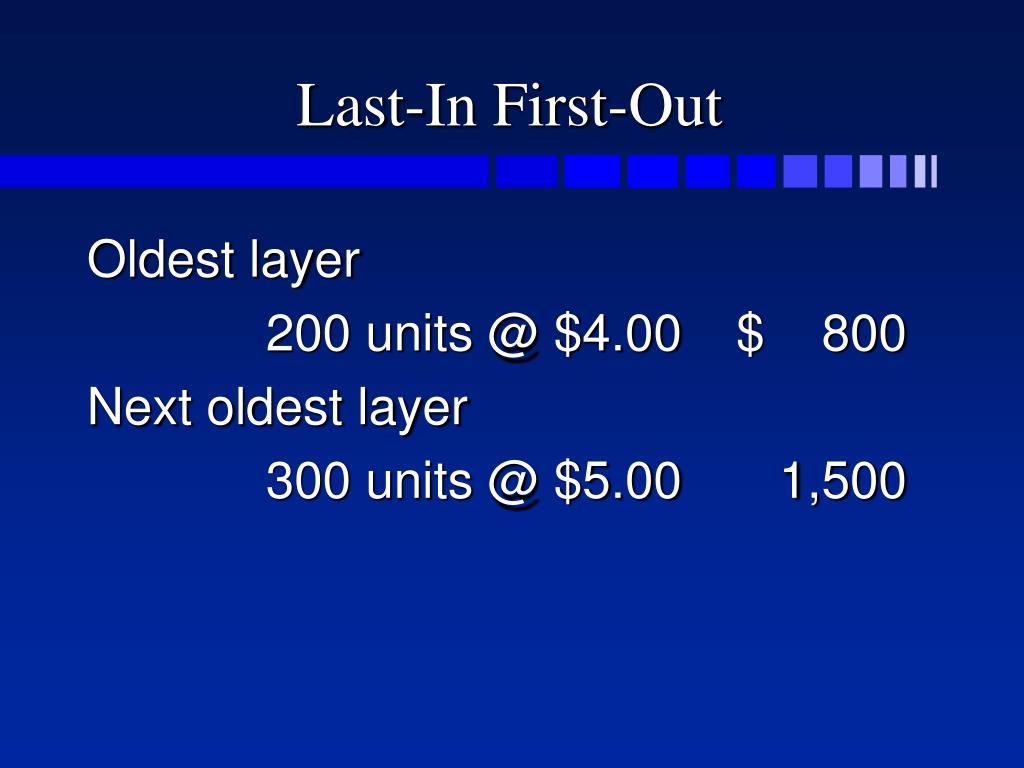

Additionally, using LIFO can result in lower taxable income, as it typically leads to higher COGS and lower reported profits. If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results. When prices are stable, our bakery example from earlier would be able to produce all of its bread loaves at $1, and LIFO, FIFO, and average cost would give us a cost of $1 per loaf. However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period.

What does LIFO stand for?

The $1.25 loaves would be allocated to ending inventory (on the balance sheet). Virtually any industry that faces rising costs can benefit from using LIFO cost accounting. For example, many supermarkets and pharmacies use LIFO cost accounting because almost every good they stock experiences inflation.

Is LIFO Illegal?

We’ll explore how both methods work and how they differ to help you determine the best inventory valuation method for your business. Inventory management is a crucial function for any product-oriented business. First in, first out (FIFO) and last in, first out (LIFO) are two standard methods of valuing a business’s inventory. Your chosen system can profoundly affect your taxes, income, logistics and profitability. FIFO is generally accepted as the more accurate inventory valuation system.

What is an example of LIFO?

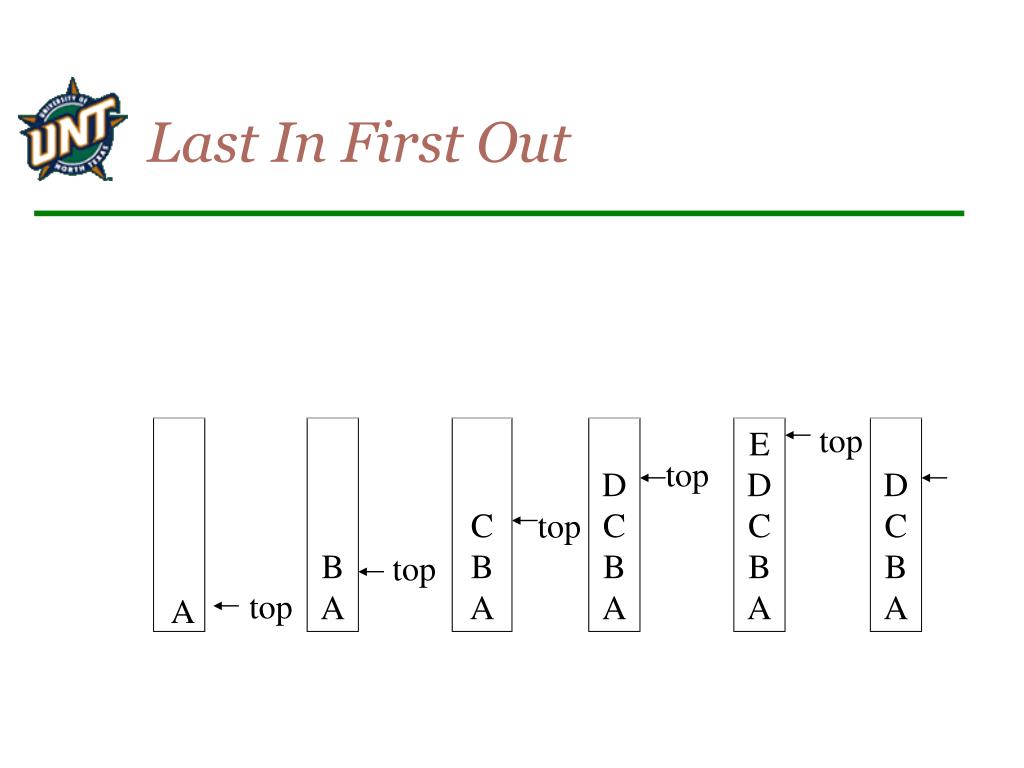

LIFO method values the ending inventory on the cost of the earliest purchases. Out of the 18 units available at the end of the previous day (January 5), the most recent inventory batch is the five units for $700 each. She launched her website in January this year, and charges a selling price of $900 per unit. No, the LIFO inventory method is not permitted under International Financial Reporting Standards (IFRS). Both the LIFO and FIFO methods are permitted under Generally Accepted Accounting Principles (GAAP).

- While LIFO offers advantages such as tax benefits and reflecting current market prices, it also comes with limitations, including distorted profit reporting and complex accounting requirements.

- Other methods include specific identification, weighted average cost, and retail inventory method.

- By offsetting sales income with their highest purchase prices, they produce less taxable income on paper.

- While LIFO is used to account for inventory values, in truth, it would be impractical in the real world.

When calculating their cost of goods sold for the period under LIFO, only the 50 widgets purchased for $20 each and 50 widgets purchased for $13 each will be included, totaling $1,650. Using LIFO to arrange inventory would ensure that the oldest inventory would become obsolete and unsellable, being constantly pushed in the back of the store to make room for the newer items up front. If the only inventory that was sold was the newer items, eventually the older stock would be worthless. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. She has more than five years of experience working with non-profit organizations in a finance capacity.

Of course, the assumption is that prices are steadily rising, so the most recently-purchased inventory will also be the highest cost. That means that higher costs will yield lower profits, and, therefore, lower taxable income. In addition to impacting how businesses assign value to their remaining inventory, FIFO and LIFO have implications for other aspects of financial reporting. Some key elements include income statements, gross profit, and reporting compliance. Since the cost of labor and materials is always changing, FIFO is an effective method for ensuring current inventory reflects market value. Older products are assumed to have been purchased at a lower cost, so when they’re sold first the remaining inventory is closer to the current market price.

Companies that sell perishable products or units subject to obsolescence, such as food products or designer fashions, commonly follow the FIFO inventory valuation method. FIFO and LIFO have different impacts on inventory management and inventory valuation. In most cases, businesses will choose an inventory valuation method that matches their real inventory flow. Thus, businesses that choose FIFO will try to sell their oldest products first. FIFO has advantages and disadvantages compared to other inventory methods. FIFO often results in higher net income and higher inventory balances on the balance sheet.

Many convenience stores—especially those that carry fuel and tobacco—elect to use LIFO because the costs of these products have risen substantially over time. Using the newest goods means that your cost of goods sold is closer to market value than if you were using older inventory items. When reviewing financial statements, this hire accountants can help offer a clear view of how your current revenue relates to your current spending. We’ll explore the basics of the LIFO inventory valuation method as well as an example of how to calculate LIFO. We’ll also compare the LIFO and FIFO inventory costing methods so you can choose the right valuation system for your business.

In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses. Do you routinely analyze your companies, but don’t look at how they account for their inventory? For many companies, inventory represents a large, if not the largest, portion of their assets.